By Jessica Mulvihill, Principal, Venture Investing

90 percent of target emission reductions can be achieved through technologies that already exist. Climate tech doesn’t have an innovation problem, it has a scaling problem. Most of the technology needed to achieve decarbonization has already been created, but is not yet widely deployed. The challenge now is accelerating innovation and scale-up to achieve technical and commercial breakthroughs. And unlike other emerging technology, climate tech requires collaboration to scale.

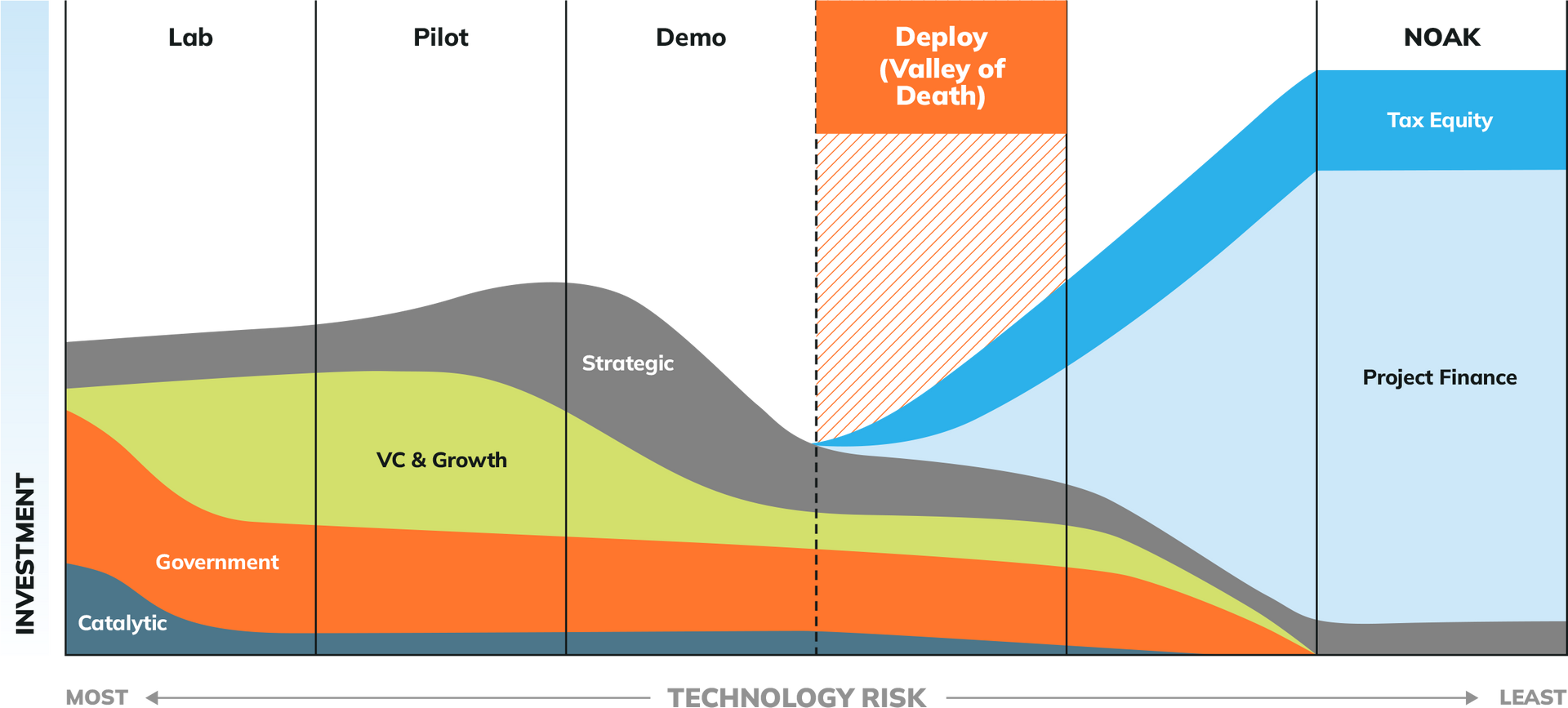

Securing deployment partnerships for large corporates is crucial in achieving net-zero goals, especially as technology moves to the scaling phase. But so far it’s been hard to get both sides of the equation to find each other in the dark. Instead, the approach to corporate/venture partnerships has been fragmented, leading to what’s now ominously referred to as the “Valley of Death.”

Otherwise known as “death by pilots”, viable and commercial-ready climate tech is struggling to hit the market because they need corporate partners, but navigating the world of large incumbents is expensive, time-consuming, and opaque. Corporates are eager for innovation but often struggle with taking on execution risk alone. With no guarantees that upstream or downstream peers will do the same, interoperability challenges threaten to make novel technologies redundant, irrelevant, or too expensive without scale. There’s financial risk associated with operationalizing technology that might be out-competed by another startup partnered with rival corporate players, or even by a completely different technical approach going after the same market. Incumbents are understandably wary of making dead-end bets. The resulting corporate stalling has created a bottleneck for climate tech deployment – and emissions reductions.

The transition from demo stages to commercial implementation is often a point of failure for young climate tech companies. Although many will have already de-risked their technology, most startups in this space just need real-world deployment opportunities to validate technological and commercial assumptions. On the other hand, the dearth of market-ready technologies leaves corporates struggling to meet their climate ambitions, as they’re faced with higher-risk technology investments that cannot meet the scale or timelines they need.

One of the main contributing factors to the deployment-stage Valley of Death is a lack of Series B funding, along with a widening timeline gap between Series A raises and Series B raises. Climate Tech VC recently reported that the time between A and B rounds has now reached 26 months, a 2.5x increase over 2021 timelines. Overall Series B funding dropped 24% in the first half of 2024 compared to 2023 levels as investors have pulled back and companies struggle to meet Series B milestones such as ARR targets and commercial partner agreements.

Climate tech startups face a different set of hurdles when going to raise Series B rounds. In other sectors, a Series B-stage company will be in full growth mode, having demonstrated initial commercial traction and ready to hit the gas pedal on sales and development. Conversely, many climate tech startups at the Series B stage find themselves coming out of successful pilots still without much-needed revenue from commercial deployments. And these commercial deployments are expensive; scaling climate tech is inherently more capital intensive and complex compared to software-dominant sectors. It requires building or retrofitting infrastructure, constructing facilities for manufacturing and deployment, and transporting physical materials. This is why attracting capital for commercial scaling is such an area of challenge for many climate tech startups – as Ashwin Shashindranath of Energy Impact Partners aptly put it, it’s not just the Valley of Death, it’s the Commercial Valley of Death.

Additionally – and crucially – scaling climate tech hinges on consensus across entire value chains because of its physical nature. Adapting or building new infrastructure is a huge risk for both incumbents and startups if there isn’t validation throughout broader industries or verticals. For startups, this means securing not just corporate partners in general, but the right ones at different pressure points of a supply chain. And corporate partners can make or break startups’ ability to attract capital; one of the biggest ways to de-risk an investment in the eyes of growth-stage investors is to demonstrate that you have plenty of offtake agreements lined up.

“Another consequence of having to innovate or transform an established ecosystem is that it can be expensive and time-consuming to get buy-in from incumbents…One founder was told by a mentor that, ‘trying to get a pilot with [unnamed oil major] will bankrupt you.’”

Hara Wang & Cyril Yee, Third Derivative: Climate Tech’s Four Valleys of Death and Why We Must Build a Bridge

Securing partnerships between corporates and startups can be costly and time-consuming for both parties – a burden many corporates would rather not deal with, and one that the vast majority of startups cannot afford. Large corporate growth engines find it hard to map their needs onto potential startup partners and end up spinning their wheels instead. Because agreements with the largest incumbents are hard to lock-in, many startups get pushed into working with smaller players which can’t provide the scale and growth they need. Unsurprisingly, many of the notable climate tech failures

so far in 2024 struggled to attract capital because they were unable to show demand from corporate customers and partners.

“Without…collaborative efforts through public-private partnerships, climate-tech start-ups will face ongoing challenges in the ‘valley of death’, impeding progress toward achieving net-zero goals through climate and energy technology.”

Kavita Surana, Co-Author: The effects of corporate investment and public grants on climate and energy startup outcomes

Corporate involvement here is key for the ultimate growth trajectory of companies; one recent study found that climate tech startups with at least one corporate investor more than double their exit outcomes compared to those without. While corporate investment and commercial partnerships don’t always go hand-in-hand, it’s clear that buy-in from critical value chain players is even more crucial for climate tech than other sectors when it comes to reaching full-scale. Collaboration within value chains can help expedite this buy-in, advancing commercial-ready tech and benefitting incumbents across industries. It can also pool decision-making power and scaling opportunities from SMBs, circumventing the lengthy sales processes currently draining time and money from both incumbents and startups.

Ultimately, climate tech startups need corporate partners

and collaboration from those partners to bridge the Valley of Death. The deployment of climate technologies at scale requires systemic change across entire established value chains. This is both our problem and our solution. Collaborations create transparency and promote the pooling of risk and investments, thereby helping to achieve step changes in decarbonization within and across sectors. There are

already examples of

commercial players coordinating to de-risk installation of first-of-a-kind (FOAK) climate tech. Now corporations need to work across value chains to share learnings and insights to accelerate deployment.

“The primary challenge in scaling advanced solutions over the next decade does not lie in their technological feasibility - rather, it is a challenge of confidence.”

World Economic Forum: Why accelerating the deployment of advanced energy solutions is not a technology readiness challenge

Large businesses have the capacity, reach, and resources required to accelerate decarbonization through purposeful partnerships. Mach49 ensures the success of the world's largest organizations by expertly facilitating collaborations across value chains and with emerging technologies. This means reducing upfront risk and costs associated with commercial deployments, surfacing high-potential de-risked new technologies, and sharing resources and learnings across industries, value chains, and verticals. There is an opportunity here to change the way corporate players meet their energy transition goals: a coordinated consortium approach, aimed at decreasing interoperability costs and improving commercialization risk.

If this is something you or your organization are thinking about,

get in touch.

/ MORE PERSPECTIVES FROM M49