/ WHITE PAPER

Unlocking African Prosperity: The Role of Corporate Venture Capital in High-Growth Economies

By

Grace Diida, Research Associate Venture Investing at Mach49

Picture this: 18 African countries are expanding at a rate of over 5% per year. They're not just banking on economic toughness, but are fueled by solid policies, community unity, free-market values, and robust institutions. But what are the continent’s magic formulas for winning? Interestingly, Corporate Venture Capital (CVC) plays a significant part in their growth story. Here’s how.

Understanding the Dynamics of Growth

Let’s take a step back and gain insights into the background of Africa’s economics.

Imagine a matrix separating the 54 countries in Africa into two groups; those with strong growth averaging 5% or higher, and a group with weak growth, averaging less than 5%. Within each category of growth, the country's economies are further divided into three subgroups: resource intensive countries, non resource intensive countries, and oil exporters. From these,

18 African nations stand out as having growth rates averaging 5% or higher, with only 8 being non resource intensive countries.

This is not to imply that only 18 of the 54 countries are growing, rather to point out the tremendous growth of the continent and the pathways taken by individual countries.

Let’s jump into some of these success stories and some macro trends across the continent that pave the way forward in 2024.

Rwanda,

Kenya and Mauritius have emerged as a shining example of growth, all characterized by innovation hubs, progressive policies, and a burgeoning entrepreneurial landscape.

The Mauritian economy is growing so rapidly that it disproves the pessimistic projections made by Nobel laureates James Mead in the 1960s. Mead regarded the Mauritian economy as a case of the Malthusian trap, predicting poor developmental prospects due to its heavy reliance on a sugar based agricultural sector, high vulnerability to trade shocks, rapid population growth and rising ethical tensions. Yet, in addition to maintaining national stability and social cohesion, the island economy sustained a high and stable economic growth rate averaging 5% annually between 1980 and 2000.

Kenya, a country with limited natural resources, opted for a more street smart approach. The country invested heavily in its people, turning itself into the

Silicon Savannah.

The country

attracts multinational investment and has been growing faster than its more resource-endowed neighbors.

Further north west,

Rwandan growth is also worth noting. The small country has shown consistent growth despite historical challenges, demonstrated resilience and a commitment to fostering economic stability and social cohesion. Rwanda has embraced forward-thinking policies, free-market principles, and strategic investments in key sectors like technology and education. This deliberate focus on development has propelled Rwanda into becoming one of Africa's fastest-growing economies, with sustained growth rates well above the regional average. Additionally, Rwanda's efforts in promoting

innovation hubs and creating a conducive environment for entrepreneurship, have made it a standout success story in the African context, attracting global attention from noted VC firms as a model for financial investment and pan-African development.

Growth Through Policy

Economic cooperation in Africa is essential for the continent's entire development. More and more African leaders work together to address infrastructural challenges – through continental policies and economic cooperations including trade, investment, and agriculture initiatives. These have significantly boosted innovation and corporate venture growth.

The African Continental Free Trade Area, particularly, has made a significant impact on opportunities for Corporate Venture Capital. This initiative created a single market across 54 nations, expanded opportunities for businesses, attracted investment and fostered a dynamic environment for innovation. This increased connectivity and removal of trade barriers has also facilitated cross-border collaboration, enabling corporate venture capital to flow more seamlessly.

Regional Economic Communities of Note

- Economic Community of West African States (ECOWAS)

- East African Community (EAC)

- Common Market for Eastern and Southern Africa (COMESA)

Cross border initiatives have

eliminated costly tariffs on goods, facilitated free movement of

regional citizens, harmonized customs procedures and promoted regional integration, as well as the development of a single market for goods and services. These cooperative policies, protocols and programs have set the foundation for growth, expanded the market and boosted opportunities for startups.

Why Corporate Venture Capital is the Last Piece of the Growth Puzzle

On a global scale, corporate venture capital has emerged as a dynamic force driving innovation and economic growth. According to Pitchbook, corporate venture capital grew from $12 billion in 2011 to $194 billion in 2021. This

represents almost 30% of the $675+ billion in venture capital dollars deployed in 2021.

Africa, with its burgeoning entrepreneurial landscape, growing population, and untapped potential, presents a unique canvas for Corporate Venture Capitalists to flourish.

In a survey by the African Private Equity and Venture Capital Association (AVCA), over 70% of respondents recognized corporate venture capital as a pivotal enabler of innovation and job creation.

South Africa, Nigeria, Kenya, and Egypt emerge as the vanguards of

CVC in Africa, with Mauritius and Rwanda quickly catching up. These countries boast robust startup ecosystems, propelled by an educated workforce, willingness to adopt new technologies, and substantial venture capital investments.

South Africa's largest cities, Johannesburg and Cape Town, exhibit a vibrant tech ecosystem, while Nigeria's Lagos has become an emerging hub for fintech and agritech. Kenya's East African innovation prowess shines in mobile and finance, and Egypt's Cairo showcases a thriving tech scene with investments primarily in fintech and healthtech startups.

Africa's extractive industries, notably

oil and gas as well as

mining, have shown robust financial capacity to engage in Corporate Venture Capital.

TotalEnergies' engagement with African energy startups exemplifies this trend, with a focus on renewable energy solutions and innovative technologies that align with sustainability goals.

Similarly, telecommunications and IT giants such as

MTN Group have recognized the potential of corporate venture capital, funneling investments into digital services startups and fintech ventures. The financial services sector, epitomized by

Absa Bank's fintech-focused venture arm, is also seizing CVC opportunities to harness fintech innovations that redefine banking and financial inclusion.

Other regional and international examples include:

- Orange Digital Ventures, the CVC arm of Orange, a French telecommunications company with a large presence in Africa. Orange Digital Ventures has invested in a number of startups, including Kibo, Jokkolabs, and Wave.

- Alibaba Africa Fund, the CVC arm of Chinese e-commerce giant Alibaba, has invested in a number of African startups, including Jumia and Hello Group.

- Sony Innovation Fund, the venture arm of the Japanese conglomerate, is looking to invest in seed and early stage startups across the continent in gaming, music, film and content distribution.

Corporate venture growth is just starting on the continent, leaving room for corporate giants such as I&M bank (Kenya), Shoprite (South Africa), Equity bank (Kenya), Sahara group (Nigeria), Eskom (South Africa) and Safaricom (Kenya) to take advantage, as first movers in the upwardly mobile continent.

Can Corporate Venture Capital Play a Role in this Next Wave of African Growth?

The short answer? Yes. The stage is set for Africa to harness its latent potential and emerge as a global innovation powerhouse. More specifically, while outside venture capital has been firmly implanted throughout the region, corporate venture capital is a strategic imperative that holds the keys to unlocking innovation, economic growth and sustainable development.

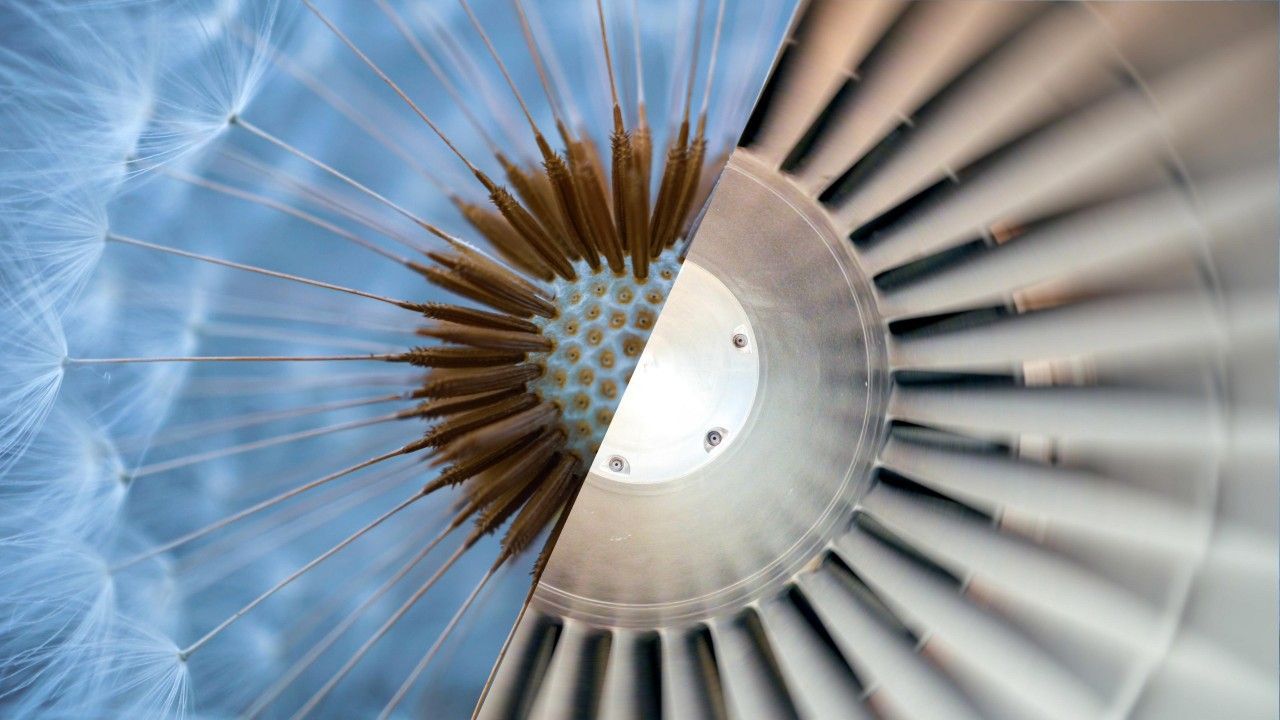

As policy shifts begin to resolve the challenges of regulatory complexities and cross-border trade is simplified, industries capable of affording a corporate venture arm are increasingly intersecting with beneficiaries seeking to participate in the innovation sector. The fruits of this labor are already starting to show – with multiple unicorns sprouting faster and faster.

In 2021, just six years after its founding, eLearning platform Go1 became South Africa's first tech scale-up to be valued at more than

$1 billion. Other unicorns such as Interswitch, Flutterwave, and MNT-Halan, all boast impressive traction and valuations ranging from

$1-3 billion.

Corporate venture players remain the last piece of the puzzle in a sector amping up and growing fast in Africa. The speed of corporate cooperation will, in the next five years, separate the winners from the moribund, and the dynamic from the static.

To the corporate players looking to expand – it’s your move in Africa.

Let's Connect

Mach49 Perspectives

Turning ideas into thriving businesses takes new, fresh perspectives. Here we offer a few. From people who have been building and investing in ventures for decades, corporate innovation teams that are just getting started, and your potential customers. Some perspectives shared are unusual, most are provocative, all will get you thinking about venture-driven growth.